Democratized Prime - How to Use as a Lender

Curious on how to lend your cash with Democratized? Let us walk you through it.

By Moustapha Saab

July 25, 2025

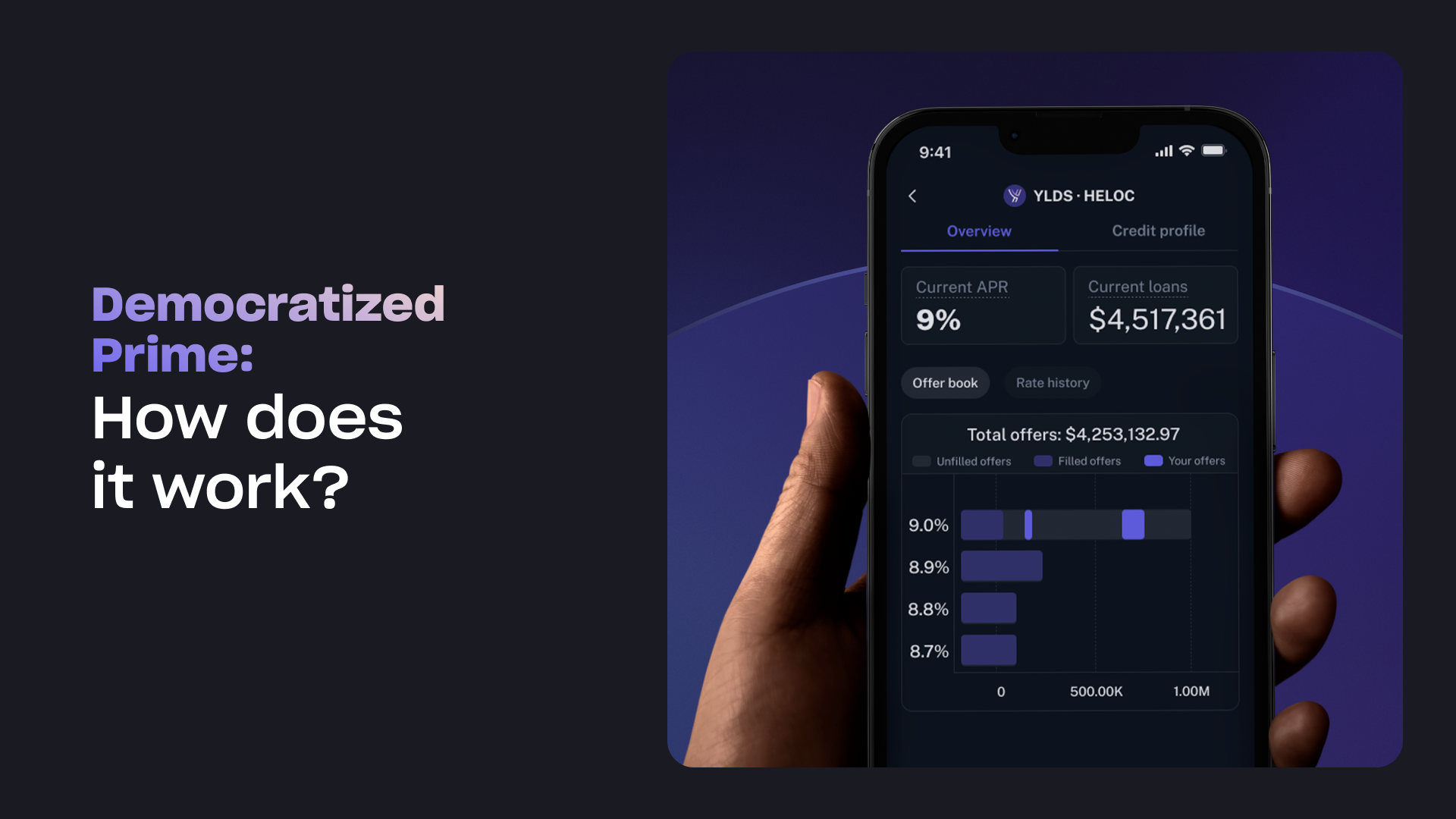

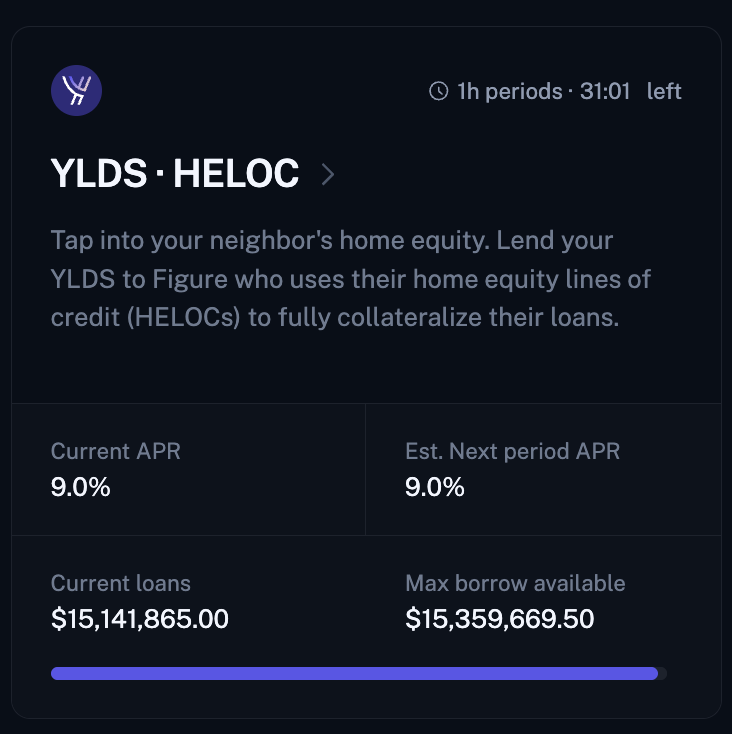

Democratized Prime (DP) is Figure Markets’ decentralized borrow-and-lend marketplace.

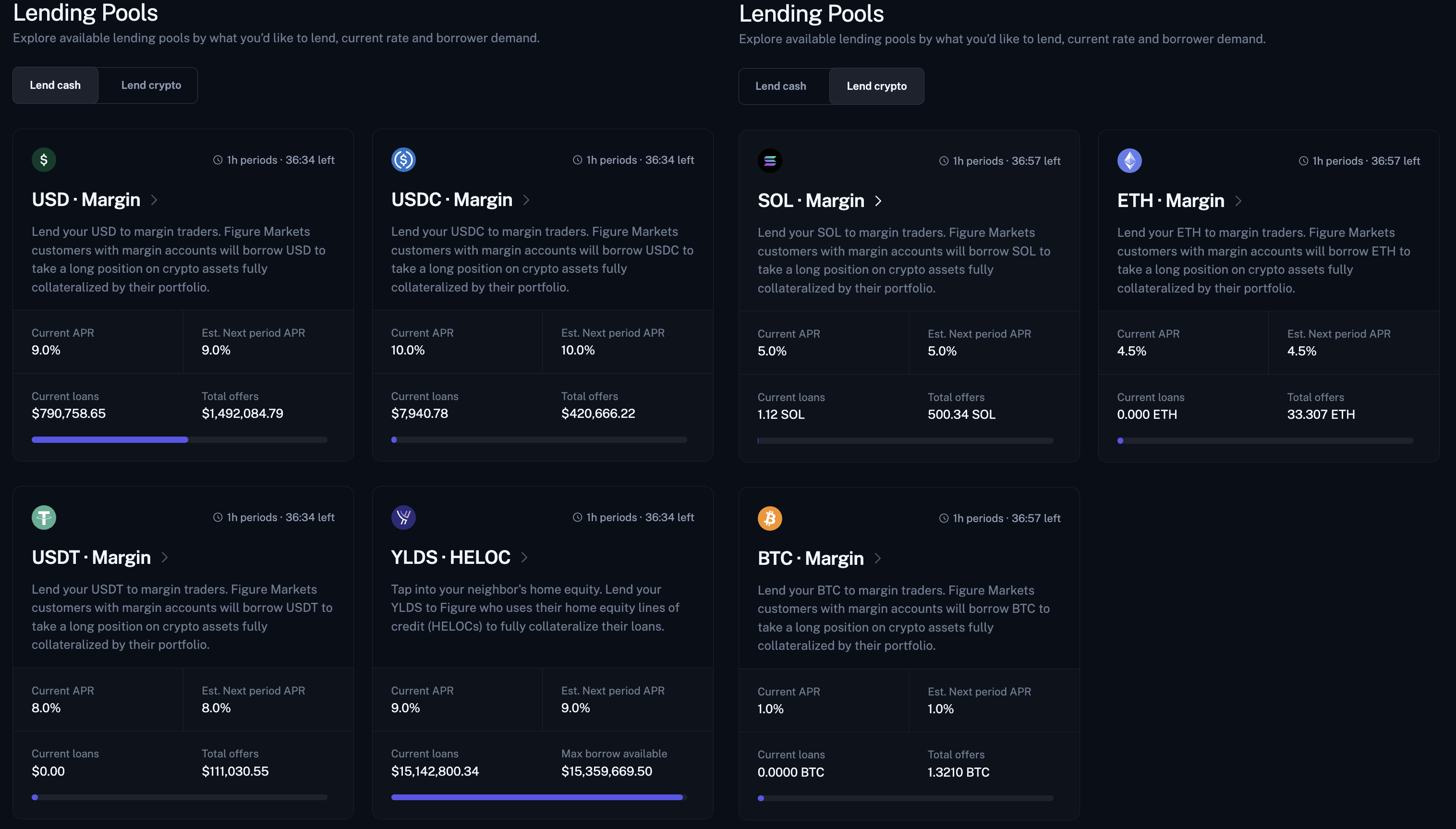

Institutions post cash-flowing assets as collateral in order to borrow working capital. Lenders, whether individuals or institutions, supply that capital and earn a yield that tracks the income those assets generate. Two lending pools are live today real-world HELOCs (RWAs) & Margin positions; dozens more are planned.

Type of Lending Pools Currently Available:

- Real-world HELOCs (RWAs)

- Margin-trading positions

This article focuses on the YLDS-HELOC pool, where lenders post YLDS, Figure Markets’ SEC-registered yielding stablecoin.

Lets start with YLDS and why it’s paired on the other side of the pool

- Baseline yield: Simply holding YLDS accrues interest at SOFR minus 50 bp (currently about 3.85% as of 7.17.2025).

- Earning while bidding: because you are earning while bidding, if your offer is not accepted in the auction, you are still bringing in a return while waiting because your bids is in YLDS, a yield bearing stablecoin.

Participating as a Lender: Step-by-Step

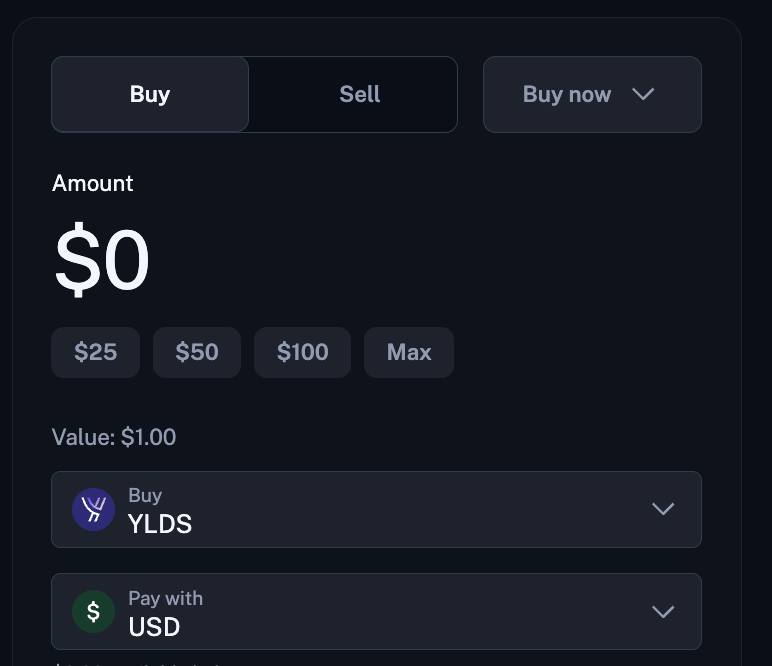

1. Acquire $YLDS - purchase directly in the Figure Markets app or on the web 1 USD = 1 YLDS

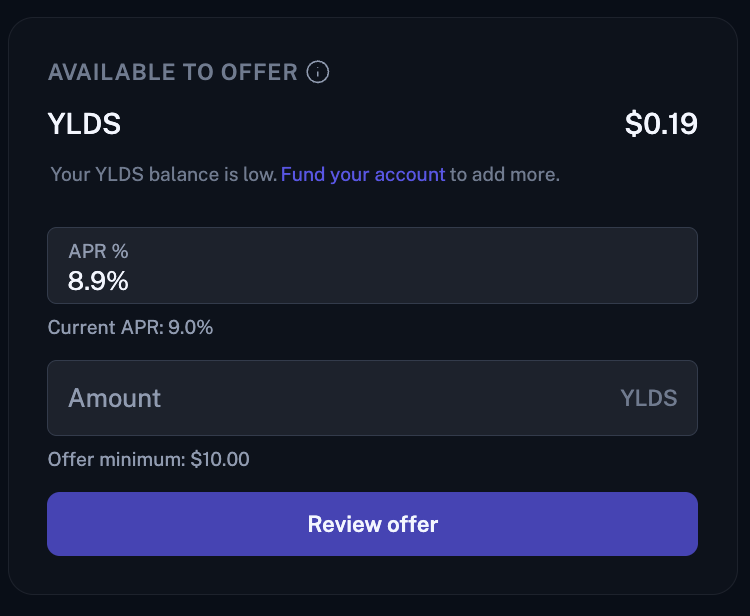

2. Create a lending offer - choose the amount and the minimum rate you are willing to accept.

3. Await hourly auction - all filled lenders receive the single clearing rate, even if they bid lower.

4. Earn interest immediately - filled offers start accruing at the clearing rate for the entire hour and $YLDS is held to make the offers, participants earn yield via holding.

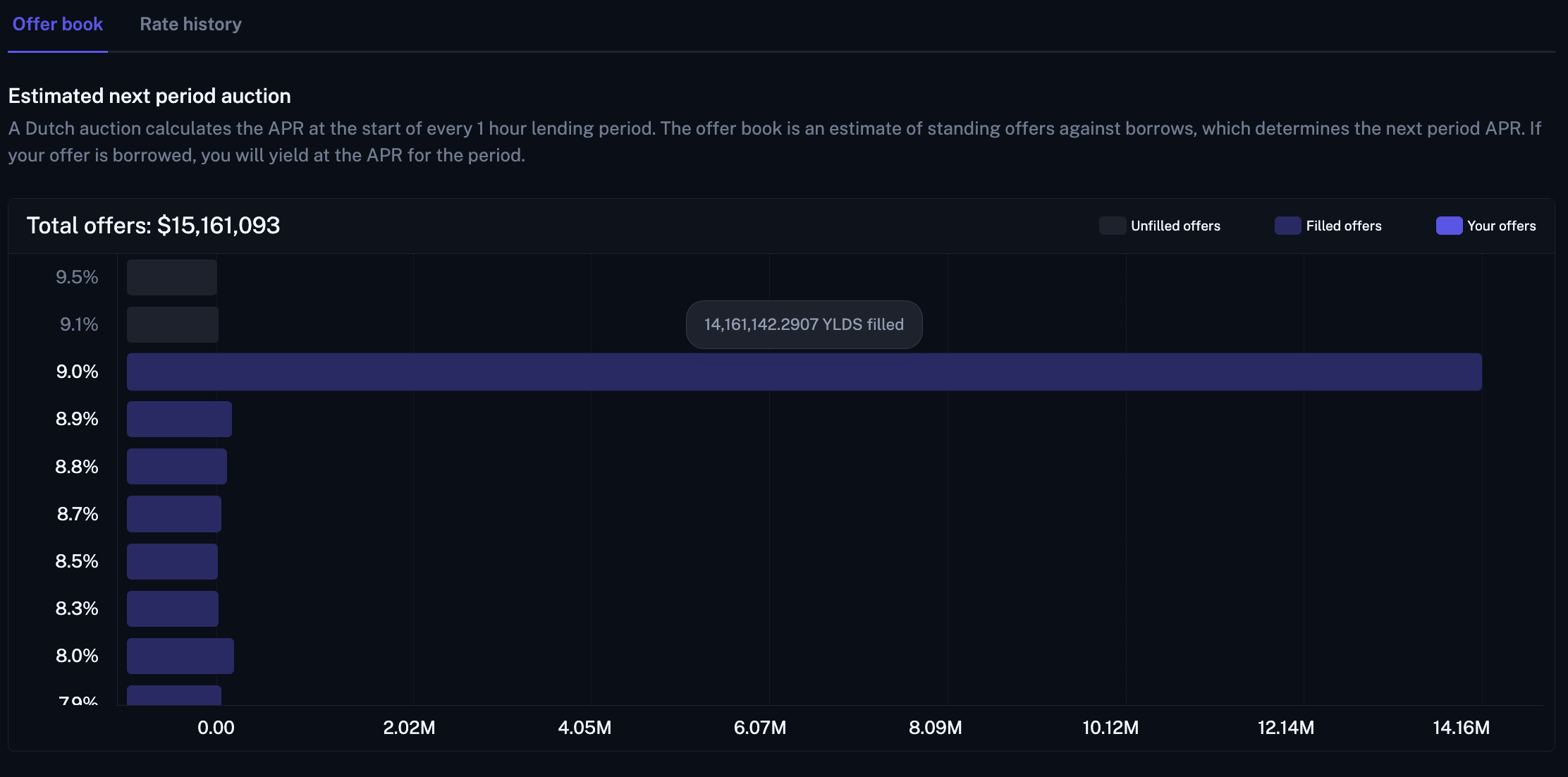

Inside the Hourly Dutch Auction

- Submission: Your YLDS transfer moves into the DP smart-contract orderbook.

- Clearing: At the top of the hour, the contract selects the highest borrowing rate required to satisfy demand; that rate applies to all lenders filled during the cycle.

- Settlement: YLDS shift from the orderbook to the borrower’s wallet. The borrower now holds an interest-bearing stablecoin and is obligated to service the loan at the auction rate.

- Withdrawing: if you wish to withdraw, you can do so after each hour clears. You can withdraw as much funds as you’d like if there is enough in resting liquidity to do so. If there is not, rates will spike to 30% until more liquidity is added.

Borrow demand is displayed as “Max orderbook size.” Borrowers accept only those lender offers that meet—or undercut—the rate they are prepared to pay.

Example: A $2,000 YLDS Offer

- Enter $2000 at 8.0%; submit.

- Offer queues below the current 9.0% clearing rate.

- Auction clears; your offer is accepted and filled.

- Interest begins accruing at 9% and rolls every hour

- Borrower now earns ≈ 3.8% on the YLDS they hold, while paying 9% to the pool. They can then decide what to do with their YLDS after.

Risk Management and Collateral Protection

- Over-collateralization: Borrowers may draw only up to 90% of pledged loan value, leaving a 10% cushion.

- Liquidation: If a borrower fails to repay, collateral liquidates to cover lender principal and interest.

- Transparency: Collateral metrics update hourly on the DP dashboard.

Looking Ahead

As additional asset classes join the platform, DP will operate multiple, independent pools. Each pool will follow the same Dutch-auction mechanics, allowing yields to adjust automatically to real-time supply and demand.