Staking vs. Real-World Yield

Why a 9% Mortgage Pool Can Beat Token Inflation

By Moustapha Saab

July 24, 2025

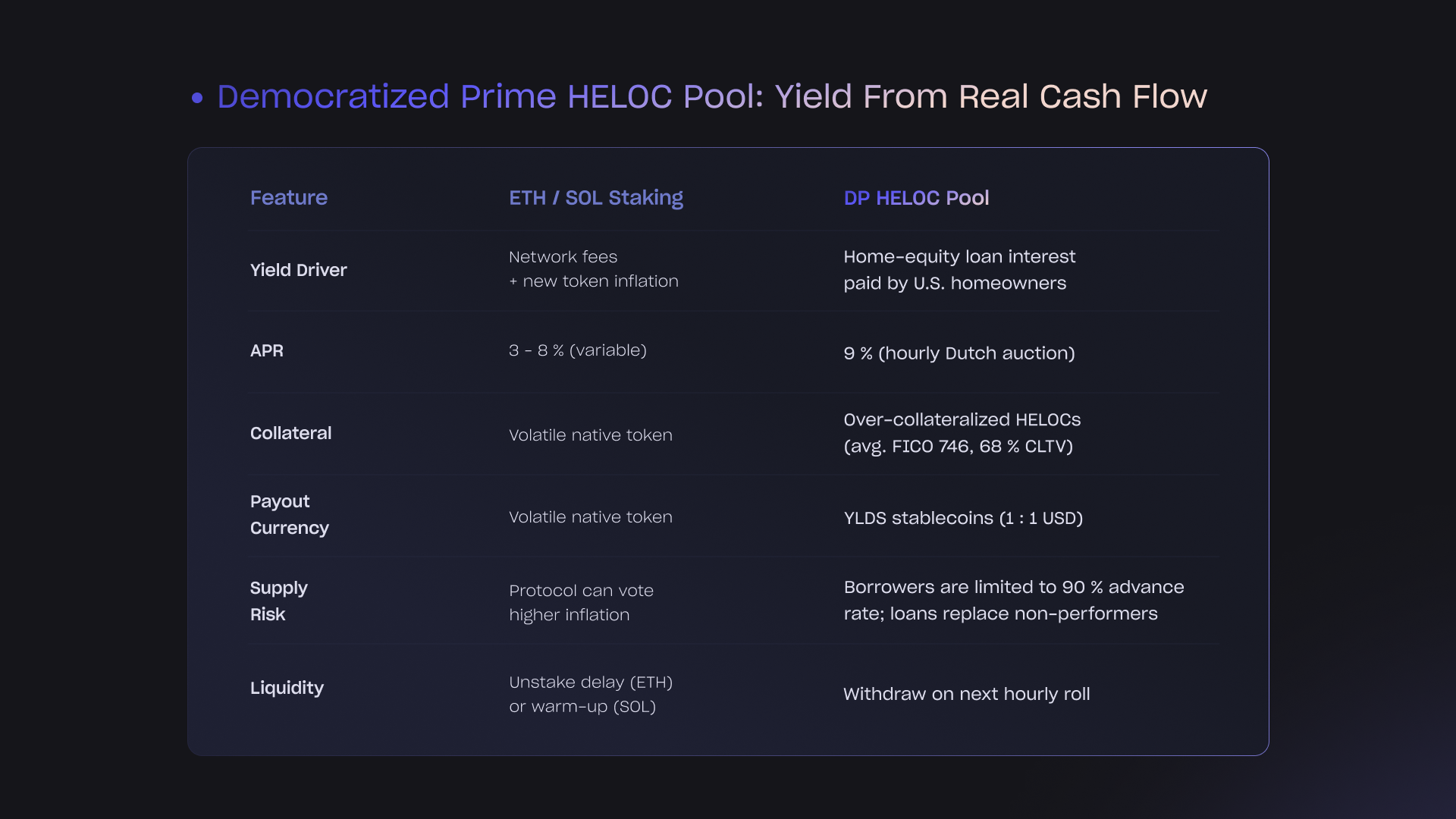

“Stake your SOL for 7%!” “Lock ETH and earn 4%!” Crypto timelines overflow with headline yields, yet most of those numbers rely on token inflation rather than durable cash flow. In contrast, Figure Markets’ Democratized Prime (DP) HELOC pool pays around 9% from homeowners’ interest payments - not from printing new tokens. Here’s how the mechanics differ and why a tokenized real-world-asset (RWA) yield can be the better option.

1. Ethereum Staking: Good Mechanics, Limited Ceiling (1)

- Yield source: a blend of priority fees and newly created ETH that helps keep the network secure.

- Typical range: ~3 – 5% APR when the chain is busy; can go lower during quiet periods.

- Volatility kicker: rewards are paid in ETH, an asset whose USD price can swing 30 % in a month.

Bottom line: the fee component is healthy, but demand caps network revenue—so the yield ceiling remains low unless you sell ETH rewards quickly.

2. Solana Staking: High APR—But Mostly Inflation (2)

- Yield source: inflationary SOL issuance plus tiny network-fee rebates (fees < $0.0003 per transaction).

- Current range: 6 – 8% headline, yet > 90 % of that comes from minting new SOL.

- Risk: you’re effectively diluting yourself if SOL price stagnates; any market drawdown erases nominal gains.

- Sustainability: fee revenue would have to multiply many times over to replace inflation. Until then, high quoted APRs are a subsidy, not organic yield.

3. “Stake-to-Earn” DeFi Tokens: Pure Dilution (3)

- Numerous DeFi apps offer double-digit APRs without paying from protocol revenue.

- Rewards come only from token inflation or treasury handouts. There is no real cash-flow that backs them.

- Very volatile, if the token price collapses then the effective yield turns negative.

4. Democratized Prime HELOC Pool: Yield From Real Cash Flow (1)

Comparative analysis made by Figure Markets Holdings Inc. as of 7/22/2025

Comparative analysis made by Figure Markets Holdings Inc. as of 7/22/2025

Why It’s Sustainable:

Homeowners pay Figure ~10% on their HELOC balances. Figure keeps a small servicing spread and routes the remaining ~9% to lenders in DP. The flow is simple: borrower → smart contract → lender—no mint-to-pay subsidy and no reliance on bull-market trading fees.

Every day your cash sits in an inflation-funded staking contract is a day it could be earning higher, real-world yield with less volatility and lower risk in Democratized Prime. Check the current clearing rate in the Figure Markets app; the difference speaks for itself.

Sources: (1) / (2) / (3)

DISCLOSURES: The material provided herein, current as of the date hereof, has been prepared by Figure Markets Holdings Inc. This comparison is provided for informational purposes only and is not intended as investment advice or a recommendation to buy or sell any security or financial product. The Democratized Prime platform lending pools and the tokens referenced herein (Solana, Etherium) are not directly comparable, and represent materially different staking structures, risk profiles, liquidity characteristics, and regulatory oversight. Investors should conduct their own independent analysis and consult with a qualified financial advisor before making any investment decision. The 9% rate referenced is not guaranteed and subject to change as new offers are placed. Democratized Prime uses a Dutch auction method for its borrowers/lenders. There is an inherent risk due to interest rate volatility in a Dutch auction interest rates in the auction may rise rapidly. At the time of acceptance, your loan may be filled with a different or higher interest rate than offered at the time of selection. The interest rate is only fixed at the time of loan approval and not at the time of loan acceptance. More information on the loan pool, specifically the aggregated HELOC Credit Profile for borrowers can be found here.

Participation in the mentioned lending pool within Demo Prime is exclusively conducted using YLDS. YLDS must be purchased prior to participating in the lending pool. No other tokens or currencies (including USD or USDC) can be used for lending in this pool. YLDS Stablecoins are unsecured face-amount certificates and solely backed by the assets of Figure Certificate Company (FCC), who is the issuer of the certificates. More information about YLDS and FCC can be found here.